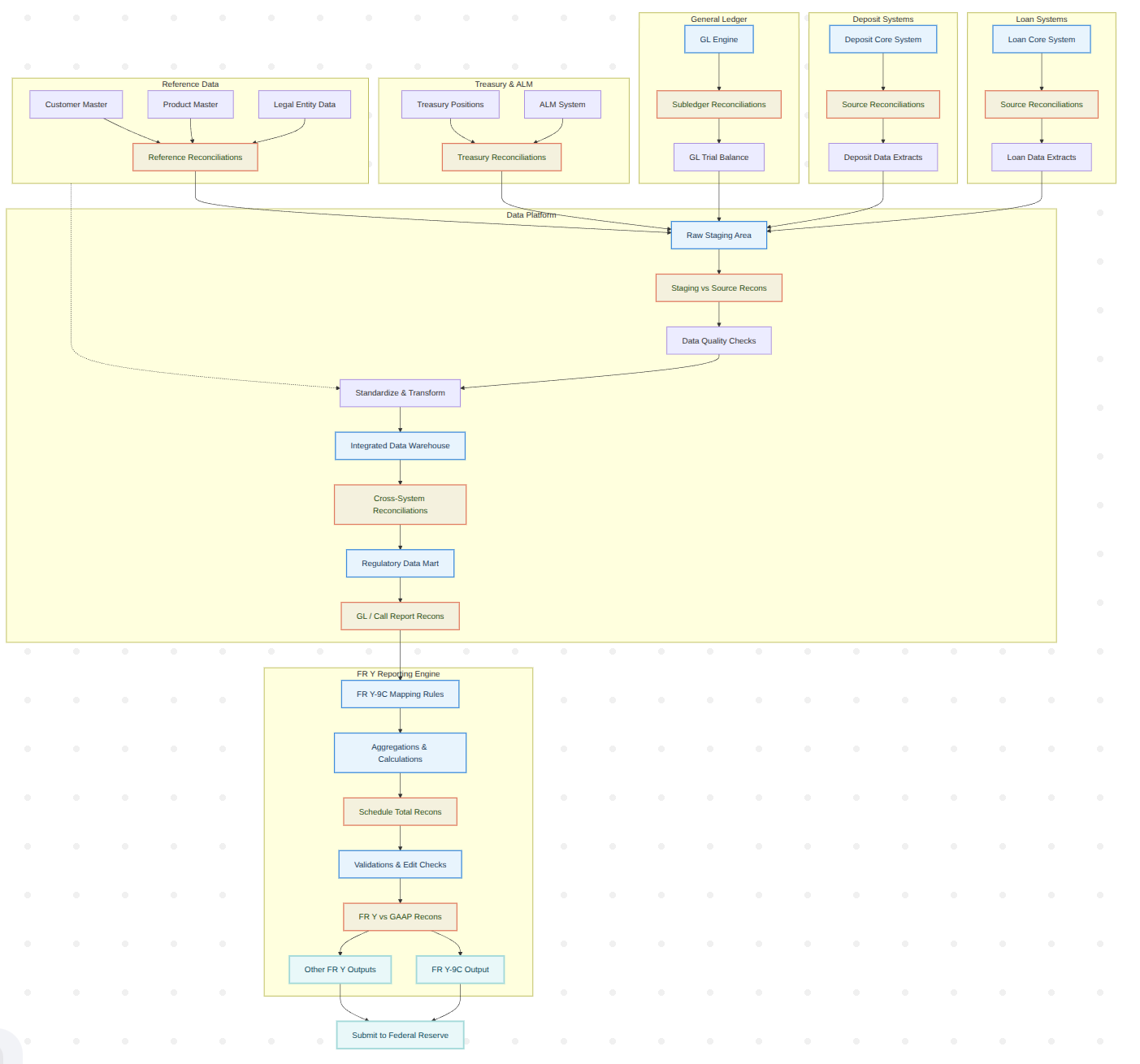

Complete Financial Regulatory Reporting Pipeline

This comprehensive pipeline demonstrates how data flows from multiple source systems through reconciliation and standardization processes to generate regulatory reports for submission to the Federal Reserve.

End-to-End Regulatory Reporting Pipeline

This comprehensive pipeline demonstrates the complete data flow from source systems through reconciliation and standardization to regulatory report generation. The pipeline includes:

This entire pipeline—from source extraction to regulatory submission—can be generated by DagUI in days, ensuring compliance and reducing manual effort.

Build Your Pipeline